Introducing DeepBook Margin: The Next Evolution of Sui’s Liquidity Layer

DeepBook Margin transforms DeepBook from a spot trading engine into a programmable financial layer for Sui

Main Takeaways

- Apps can natively embed margin, rewards, and liquidation logic through DeepBook’s shared infrastructure.

- Liquidity on Sui shifts from static pools to an active system that supports borrowing, risk management, and execution.

- DeepBook Margin unlocks more capital-efficient markets, structured strategies, and new financial primitives on Sui.

Overview

Sui has rapidly grown into one of the most active ecosystems in crypto, with new markets, applications, and trading layers emerging across the network.

But even as activity increased, liquidity on Sui remained largely underutilized: siloed in pools, earning single-stream yield, and unable to support anything beyond spot trading. What the ecosystem lacked was the foundation for what comes next. Markets powered by borrowed liquidity, structured and automated strategies, and new forms of capital efficiency that simply weren’t possible yet.

DeepBook changed that trajectory. As the shared order book of Sui, DeepBook became the invisible engine behind the ecosystem’s trading stack. It has already powered over $17B in cumulative onchain volume, giving builders deterministic, high-performance execution they can rely on.

Now, that engine is entering its next phase.

DeepBook Margin is a new protocol layer that enables developers to integrate margin trading and reward mechanisms directly into their applications. DeepBook’s role expands as a core liquidity layer, giving builders easy-to-use tools to embed DeFi functionality — such as margin, rewards, and liquidation logic — directly into their apps. For traders and asset holders, it introduces new opportunities to earn passive rewards through margin activity.

This integration of reward-generating stable assets is a key step in scaling institutional-grade onchain market structure.

From Spot Engine to a Full-Scale Financial Engine

When DeepBook first launched, its purpose was clear: give Sui a fast, transparent, onchain order book capable of powering spot markets across the ecosystem. It delivered exactly that. Builders integrated it as their execution layer, aggregators routed flow through it, and traders relied on it for deeper liquidity and fairer pricing.

But DeepBook was never meant to remain just a spot engine.

As more protocols launched on Sui, one pattern became obvious: every team, whether building a DEX, a perp venue, a vault, or a structured product, needed the same underlying mechanics. Borrowing. Risk management. Execution. Capital efficiency. And the ability to do all of it without recreating liquidity from scratch.

DeepBook already sat at the center of these flows.

The natural next step was to expand its role from a passive liquidity layer into an active financial foundation for the entire network.

Margin is the first expression of that shift.

It takes the liquidity that DeepBook already concentrates and gives it new capabilities. It transforms a static pool into a productive asset base that traders, builders, and protocols can all use. And in doing so, it unlocks a new era of capital efficiency on Sui.

What DeepBook Margin Introduces

DeepBook Margin brings fully onchain, composable margin trading to Sui. Margin is powered by the same liquidity pool that DeepBook already uses to support different markets inside DeepBook itself.

With features like isolated margin pools, real-time liquidation engines, and flexible fee mechanics, DeepBook Margin now expands DeepBook from a trading venue into a fully programmable liquid layer.

Aggregators, wallets, and onchain applications can route margin trades through DeepBook Core. For traders and asset holders, it introduces new opportunities to earn passive rewards through margin activity, including the ability to stake dbUSDe to supply margin trading pools and earn passive returns on holdings.

This creates a unified system where:

- Trading is capital-efficient – Users deploy leverage directly through DeepBook’s shared execution engine, where orders are filled by diverse ecosystem flow. This delivers deeper liquidity and more reliable execution across every market.

- Liquidity providers earn more – Margin introduces active yield from borrowing and trading fees on top of existing passive returns.

- Builders can integrate margin natively – Through SDKs and APIs, developers can route leveraged flows and unlock new revenue streams without engineering a risk engine or sourcing liquidity.

It's margin as infrastructure, leverage that lives inside the network itself.

What Margin Unlocks for the Ecosystem

For the Sui ecosystem, Margin brings a unified, scalable foundation for more advanced markets, for perps, structured products, and new financial primitives.

For traders, DeepBook Margin brings fast, transparent, self-custodial leverage. Trades settle within Sui’s high-performance environment, benefiting from unified liquidity and tight execution.

For liquidity providers, the shift is even larger. Liquidity now generates both passive yield from spot and active yield from borrowing demand and trading activity. Capital works harder, and rewards become tied to real usage across Sui.

For builders and integrations, Margin introduces a points-based engagement system tied to protocol activity rather than short-term incentives. Referral mechanics and open SDKs allow ecosystem developers to route flow through DeepBook and capture value while contributing to network growth.

This model is designed to support public-good economics, where improvements in trading efficiency, ecosystem tooling, and user experience scale with network usage, creating shared benefits and a growth flywheel across Sui.

Any protocol that routes volume through DeepBook can earn revenue. Anyone can embed leveraged trading flows into their product. And no team needs to bootstrap liquidity or replicate complex risk logic.

Launching With Ecosystem Partners

DeepBook Margin launches with support from a growing set of ecosystem partners who will be among the first to activate the new system-wide leverage model.

Early collaborators include Abyss and DeepTrade, each integrating DeepBook’s shared liquidity to power their own trading experiences. These teams now gain access to a margin layer that they do not have to build themselves. Borrowing, routing, liquidations, and risk controls are all handled through DeepBook’s unified engine.

As the liquidity flywheel accelerates and demand for capital efficiency increases, DeepBook will continue onboarding protocols that want to tap into margin without inheriting the operational burden that typically comes with it.

Margin Is Just the Beginning

The launch of DeepBook Margin marks the first major step in DeepBook’s evolution from a liquidity layer into a core financial engine for Sui. It expands what liquidity can do, but it also expands what builders can create.

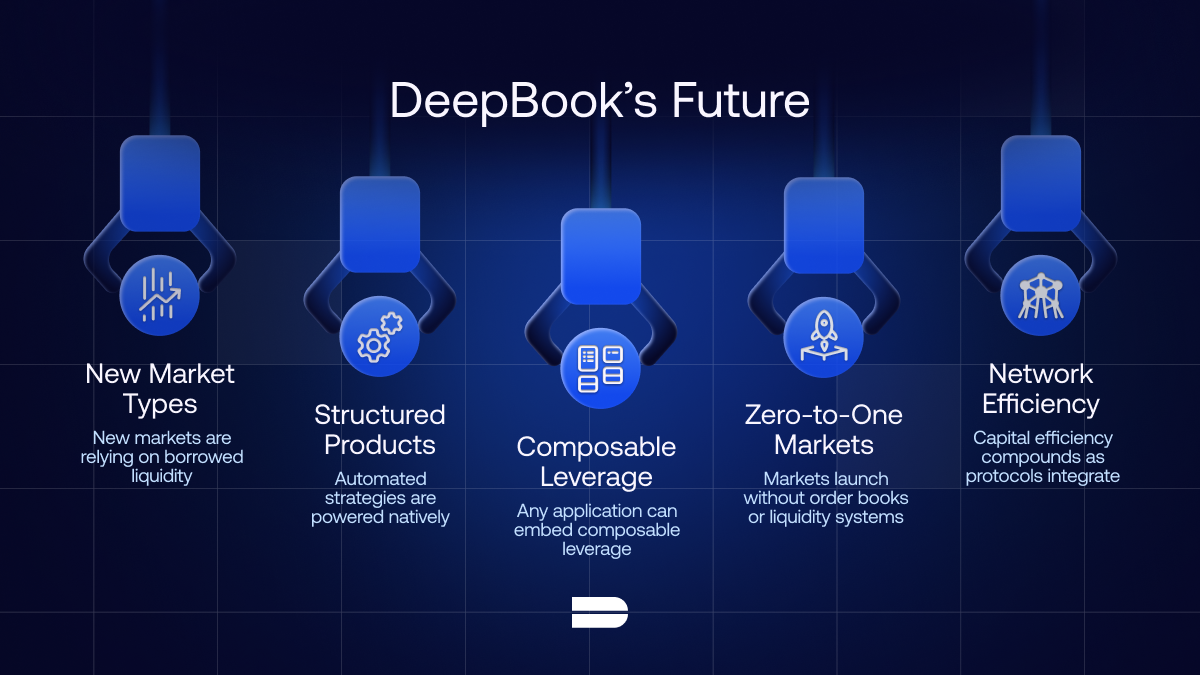

This upgrade lays the groundwork for a broader shift:

- New market types that rely on borrowed liquidity

- Structured products and automated strategies powered natively through DeepBook

- Composable leverage that any application can embed

- Zero-to-one markets that launch without building an order book, lending market, or liquidity system

- Network-level capital efficiency that compounds as more protocols integrate

Liquidity is the lifeblood of any ecosystem, but only when it moves. DeepBook Margin redefines how liquidity moves on Sui by turning a passive resource into an active, and yield-generating programmable asset that builders, traders, and protocols can all leverage.

With Margin, DeepBook becomes more than an execution layer. It becomes the financial engine at the center of Sui powering markets, accelerating innovation, and giving every participant a way to earn from the activity they help create.

A Final Note: DeepBook Points Are Live

Margin doesn’t just unlock new capabilities for builders, it also introduces new ways for users to participate in DeepBook’s evolution.

The DeepBook Points Program rewards anyone who uses margin-enabled apps, interacts onchain, or stays active as the ecosystem expands. Your activity is tracked automatically, and points accumulate throughout the season.

How to Earn Points

- Use margin-enabled apps powered by DeepBook

- Trade and interact onchain during the season

- Stay active as the ecosystem grows

The Points Program celebrates the launch of DeepBook Margin and gives early adopters a meaningful way to participate in this next phase of growth.

Note: This content is for general educational and informational purposes only and should not be construed or relied upon as an endorsement or recommendation to buy, sell, or hold any asset, investment or financial product and does not constitute financial, legal, or tax advice.