Turbos Finance DEX Offers Efficient Smart Routing

Decentralized exchange Turbos Finance offers swaps, liquidity pools with smart routing, and gamified DeFi on Sui.

Democratizing the financial industry stands out as decentralized finance's (DeFi) noblest goal. DeFi advocates want to build a peer-to-peer financial industry based on blockchain technology that delivers efficient transactions and gives people from all strata of society opportunities to invest and save.

"We envision a world where financial access isn't a privilege but a universal right," said Ted Shao, co-founder & CEO of Turbos Finance, "where the complexities and gatekeeping of traditional financial systems give way to open and accessible financial tools and platforms."

Ted and his team run Turbos, a decentralized exchange (DEX), on the Sui network, offering a variety of concentrated liquidity pools, an efficient smart routing system, and even a gamified yield earning program. Recognizing there are differing levels of DeFi expertise, Turbos includes a streamlined, "lite" interface for beginners, and a richer "pro" interface.

The Turbos team began learning and developing on Sui Devnet in 2022, and launched with Mainnet this year in May. Sui's infinite horizontal scalability, near instant finality, and minimal fees were factors that helped Turbos choose the platform. During development the team found Sui's data composability and programmable transaction blocks (PTBs) increased their velocity, while Sui's asset ownership model offered the security they needed.

Trading and liquidity pools

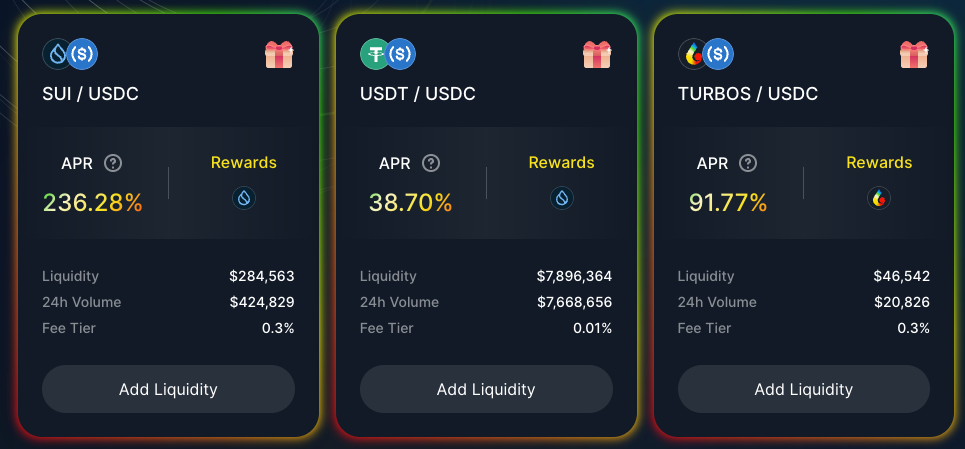

With a very active market for DEXes on Sui, Turbos differentiates itself with a smart routing feature focused on the USDC stablecoin. The company noticed that USDCeth, a wrapped version of the USDC token bridged from the ETH network, became the dominant stablecoin on Sui, commonly appearing as the denominator asset in trading pairs. USDCeth's popularity limited the usefulness of stablecoins bridged from other networks.

"Turbos pioneered a smart routing mechanism that enables users to swap the USDC bridged from BNB, Polygon, Arbitrum, and other chains directly to the Sui native asset," said Ted, "without having to swap for USDCeth first."

Through this mechanism, Turbos made it easier for people with stablecoins on other networks to engage in DeFi on Sui. Other DEXes on Sui followed and now offer similar smart routing features, creating a growing economy of stablecoins on Sui.

Beyond token swaps, Turbos offers a number of liquidity pools. Users contribute tokens in trading pairs and earn yields on those tokens. Sui's rapid time to finality on transactions means users won't have to wait for their tokens to appear in the pool. Similarly, Sui's low gas fees help Turbos keep its own fees low.

For people who find DeFi too dry, and get a glazed expression at the mention of APRs and yields, Turbos gamifies the experience with its Grand Prix feature. Here, users "fuel up" their car with a minimum of 5,000 $TURBOS, the DEX's native token, by swapping for other tokens they already hold. Every week, Turbos has a "pit stop" where users earn yields on the amount they've contributed. Tokens contributed remain in the user's wallet and can be used for other purposes.

The Grand Prix feature has proved successful for Turbos, as it records over 50,000 TURBOS token owners after six weeks of operation.

Although few market signals exist to indicate which tokens will rise relative to others, Turbos offers a dashboard showing some available data. Users can quickly see which tokens showed the greatest increase of transactions and volume over the past 24 hours, which showed the greatest increase in value over other tokens, and which wallet addresses traded the most.

Under the hood

Along with Sui's quick transaction processing times and low gas fees, both of which serve DeFi apps and users well, Turbos leverages specific Sui technologies. Ted praised Sui's emphasis on digital asset ownership.

"On Sui, only the asset owner can authorize transactions for an asset," said Ted. "This underscores the crucial role asset security plays within a DEX environment."

Turbos' development team found that Sui's Programmable Transaction Blocks (PTBs) significantly streamlined the build process. Each PTB is essentially a bundle of transactions. Creating a template that could be reused for each liquidity pool user increased developer velocity.

And while much has been made of object composability on Sui, as it applies to NFTs, the Turbos team leveraged this attribute for its data. Each liquidity position, reward, and benefit users experience in the app rely on an underlying structure of data composability.

Building for growth

Sui's DeFi growth makes it promising ground for users and builders alike. Turbos has built a platform that will support a variety of user types and activities. The team is currently looking at expanding the Grand Prix feature by offering it as a service to other ecosystem projects.

Beyond gamification, Turbos is always looking to improve functionality for its users. Similar to how it supports bridged tokens, Turbos plans to launch cross-protocol yield farming. With this feature, users can leverage their tokens to earn yields across multiple protocols. A comprehensive, step-by-step guide will make this feature accessible to users of all experience levels, and reward them for completing cross-protocol tasks.